Market expansion and the importance of regional CPCs

It’s a business owner’s dream to crack a new market, but there are many considerations when expanding into different global regions; operational costs, user behaviour, creative messaging, budgets, and plenty more. What might not feature high on the list is the average cost of an ad click (CPC) in those markets. From our experience, the CPC can be the sole factor that dictates how successful your paid media campaigns can be; no matter how strong your click-through or conversion rates, if the CPC is too high, your profit margin will inevitably be too low.

For our UK clients, the most appealing markets are Europe, the United States and Australia. Operational costs here tend to be the most accessible, and as most users in these regions speak English, there is less barrier to entry with ad creation.

But what do CPCs look like here?

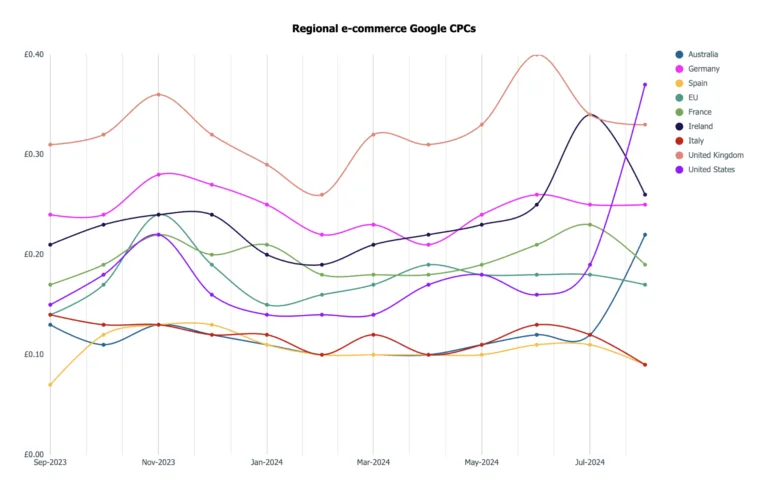

The graph above presents a comprehensive view of CPC trends across key global regions for an e-commerce client from September 2023 to August 2024. If you’re a UK business, this should be of particular interest to you. We see the highest investment for this client in the UK, which inflates the UK results as we’re supporting more SKUs here, but coverage of the other markets is fairly even.

However, if you are a UK business, chances are your competitors are also UK based, so your own data will likely look similar to this as the UK (a relatively small island) becomes more competitive between you and your peer set.

So what does this data tell us?

November was a common period for CPCs to increase across the majority of regions, including most EU markets alongside the UK and US coming close. Retail peak season is naturally the most competitive leading up to the major calendar events such as Black Friday and Christmas. If you’re considering expanding in one of these markets during these high-cost months you should expect high CPCs and a low ROAS.

Post-peak in February we see the lowest CPCs continuing into spring and summer where you see some consistency in CPCs. This could be a good launch-date, as this time can offer predictability, making them attractive for long-term campaigns where cost stability is key.

Spain and Italy saw consistently low CPCs throughout 2023 and leading into 2024, whereas Australia started to spike late 2024. Although Spain lags some way behind the leading European e-commerce markets of the UK, Germany and France, moving into a region early can help capitalise on less competition for market share.

That leaves us with the middle-ground regions such as Ireland and France. These can be used as markets for stability and consistency, fluctuating less so than other markets.

Regardless of which market we’re looking at, CPCs will consistently rise YoY. This data can help you make smart decisions when thinking about market expansion. Here are some key points to help you manage your CPCs:

- Diversification: Spread campaigns across regions to mitigate risks from price volatility. Leverage different ad platforms and media channels depending on regional price trends.

- Seasonal Campaign Planning: Understanding when CPCs are low can help schedule high-impact campaigns to take advantage of reduced costs, particularly in markets like Australia and Ireland.

- Targeting Efficiency: Use data-driven insights to segment audiences and allocate higher budgets to regions like the U.K. where costs are high but potentially offer a higher return.

- Real-time Monitoring: Regularly monitor these trends and adjust your strategy dynamically. Regions with rising prices might call for reduced spending or a shift to less expensive regions while still maintaining a presence in critical markets like the U.K. and U.S.

By closely monitoring regional CPC trends, aligning campaigns with seasonal cost variations, and leveraging region-specific strategies, marketers can maximise their budgets, reduce unnecessary ad spend, and improve overall ROI. Data-driven decisions will enable marketers to effectively navigate the complexities of paid media in an evolving digital landscape.